An alternative investment class is an asset outside of stocks, bonds and cash assets.

With stock valuations high, bond yields at all-time lows, and banks advertising .5% yields on “high” yield savings accounts, investors are flocking to alternatives.

Often, the risk is worth the reward: recent innovations have provided regular investors with smart ways to diversify their portfolios and grow their wealth.

In fact, investing in alternatives often means investing your own money the same way a bank would invest it. The only difference is that you’re the one profiting instead of the bank.

Jump To

8 Best Alternative Investment Classes

Here’s a list of alternative investments to consider.

There’s no one best option — each has its pros and cons, so consider your goals and appetite for risk when choosing between them.

#1. Real Estate

There are dozens of ways to invest in real estate, including single family homes, apartment buildings, vacation properties and even real estate backed loans.

To narrow down your options, ask yourself two questions:

- Are you willing to take on debt?

- Are you interested in being a landlord?

Both of those approaches can be profitable. But they also come with increased risk and ongoing work in the form of debt and tenants.

Investors who are not interested in being a landlord or taking out a loan can turn to crowdfunded real estate platforms, which allow you to buy into a broad range of properties along with other investors.

Depending on the platform, there’s potential to earn both cash flow and appreciation from your investment.

Best for: Investors whose portfolio is heavily allocated towards stocks, and who are looking to diversify and generate cash flow.

How to get started: Review the available investments on popular crowdfunded real estate sites. This allows you to see the range of options available, as well as what markets experienced investors are looking at. Alternatively, analyze the largest REITs (which are available in public markets).

Option 1: Cadre

For accredited investors only (which requires an income over $200,000 for the past two years or a net worth exceeding $1 million).

Launched in 2014, Cadre has returned 18.2% on average to investors. It specializes in large commercial projects located in tax-advantaged opportunity zones.

Learn more in our Cadre review or visit Cadre.

Learn more about opportunities for accredited investors.

Option 2: CrowdStreet

CrowdStreet has provided an internal rate of return of 17.6% since 2014. The platform is for accredited investors only and has a minimum investment of $25,000.

While EquityMultiple focuses almost exclusively on large institutional projects, CrowdStreet has a wider range of investment types.

Learn more in our CrowdStreet review or visit CrowdStreet.

Option 3: Fundrise

Fundrise is for the smaller investor. It has no accredited investor requirements, and its investment minimums start at $1,000. As they have smaller projects, they have the largest amount of opportunities you can pick and choose to invest in.

Learn more in our Fundrise review or visit Fundrise.

#2. Artwork

Art as an alternative investment has traditionally been reserved for ultra-high net worth individuals. That’s unfortunate, since contemporary art appreciated 14% per year from 1995 to 2020.

While you don’t get cash flow from art, blue chip art can appreciate quickly — especially when high net worth individuals have money to spend and an artist grows in popularity.

Best for: Those with a passion for art who are looking to diversify their portfolio.

How to get started: Masterworks is the first company to open up investing in art to a wide audience. It works similar to crowdfunded real estate: Masterworks’ team of expert art buyers purchases the art, and then the company makes shares of each piece available to investors.

Their goal is to sell each piece at a profit in three to 10 years. When that happens, you get a cut of the deal. If needed, you can sell your shares in the secondary market prior to that point (so your cash isn’t tied up for a decade).

Minimums start at around $20 per share and you don’t have to be an accredited investor.

Visit Masterworks.

#3. Farmland

Farmland is an alternative real estate investment that has a long and stable history backing it up. In fact, farmland in the U.S. has provided investors with an average return of 12.24% over the past 20 years, according to one calculation.

Farmland has a very low correlation with stocks. It’s also considered a classic inflation hedge, as real estate and food both tend to rise during inflationary periods.

Best for: Accredited investors with multi-year time horizons who are looking for an inflation hedge and passive income.

How to get started: AcreTrader, available only to accredited investors, allows you to buy shares in specific farms. It offers both cash flow and appreciation potential.

There are limited opportunities to invest in farmland, as profitable farms for sale are rare (and AcreTrader only accepts 1% of the deals that come to them). Nonetheless, when available, farmland can offer investors a good balance of risk and reward.

Visit AcreTrader.

#4. Cryptocurrencies

If you’re the kind of investor who panic sells a stock when it drops 20% overnight, you can skip this section. That’s because with crypto, a 50%+ drop in a single day isn’t uncommon — and wild swings like that can happen multiple times per year.

At the same time, you can’t deny how well this asset class has performed: Bitcoin has appreciated over 200% per year since inception, making it one of the best investments over the past decade.

The first question you need to ask yourself is the role you feel cryptocurrencies will play in the future. If you have a strong belief they will have a larger role in our monetary system, then it’s a viable alternative investment — as long as you go in with the understanding that there’s a high degree of risk along with the potential reward.

From there, it comes down to developing an investment strategy that’s going to allow you to stay in the game for as long as possible.

In other words, if a 50% drop overnight is going to cause (or force) you to sell — and since we can say such a drop is almost certain at some point over the next few years — you’ll end up losing and losing big.

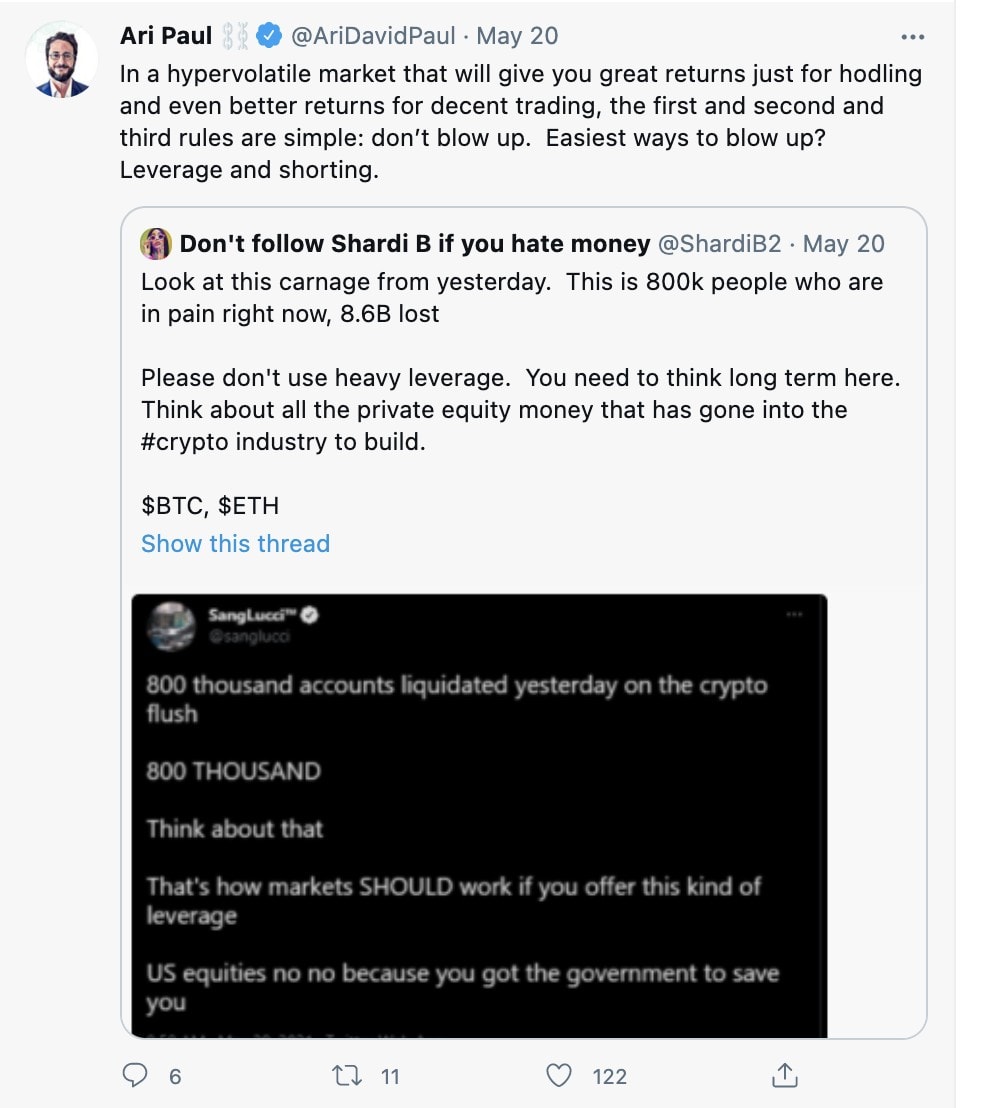

Ari Paul, who was on the team that managed the University of Chicago’s endowment before he left to start the crypto asset investment firm Blocktower, shared similar advice after a recent crash:

Best for: Investors who can handle risk and wild market fluctuations.

How to get started: Coinbase is the most popular platform for getting started with crypto. Even if you’re not ready to invest today, when you sign up for an account, Coinbase allows you to earn free crypto by learning about different investment options.

Visit Coinbase.

#5. Crypto Interest Accounts

Crypto interest accounts allow you to earn yields that are far higher than you could earn with traditional currency in standard bank accounts. And that includes so-called “stablecoins,” which are pegged to the U.S dollar.

As an example, Gemini Earn allows you to earn up to 7.99% annually on the USDC stablecoin

What’s the catch?

The first catch is that while companies like Gemini are legitimate firms that act in accordance with U.S. securities laws, there’s no FDIC insurance program for digital currencies.

Then there’s the fact that stablecoins have a limited history. They’ve held up well during market crashes so far, but there’s always the potential for a black swan type of event in the future.

Recommended resources: If you’re interested in learning more about how crypto savings accounts can pay such a high interest rate, I got a lot out of the podcast episode “How Safe is My Crypto Yield?” on Modern Finance with Zach Prince, CEO of BlockFi.

Plus, check out this article: What happens when cryptocurrencies earn interest?.

Best for: Investors who currently hold crypto and are looking to earn interest on it, as well as investors who are looking to get more from their cash holdings.

How to get started: Check out Gemini Earn, which has over 30 billion in assets under management.

See also: How to make money with bitcoin – investing, lending, trading and more.

#6. Angel Investing

It’s called angel investing because the people with the money — i.e., the angels — provide capital to startups when there’s no other source.

It’s risky. Three out of four venture-backed startups fail, which means the best venture capitalists — who, along with their money, also have the knowledge to help the company succeed — still fail 75% of the time.

Plus, even if a company does well, your money may be illiquid for 10 years or longer.

On the flip side, investing early in a future unicorn can net you tremendous gains. It’s not uncommon to return 10 to 30 times your initial investment.

Best for: Accredited investors with a high net worth who don’t have short-term liquidity needs, and who have something to offer a startup beyond their cash (such as expertise or connections).

How to get started: AngelList is a popular platform for connecting startups and investors. Browse available investments and choose to invest directly or along with popular VCs on the platform. For later-stage investing, consider Linqto, which gives you the ability to invest in already-established unicorns. Founders and early employees sometimes want to cash-out their shares before a company goes public; Linqto allows accredited investors to purchase these shares, similarly to how one purchases a stock in a publicly-traded company.

#7. Local Businesses

Investing in a small business can not only be profitable, but is also a way to support your community or an industry you care about.

Like a large corporation, you can invest by taking an equity position or through debt.

While most small businesses aren’t looking to expand and scale to a billion dollar valuation, like venture-backed startups, well-run and proven small businesses operate on very high-margins with little debt.

Best for: Investors who are looking to use their expertise in a local market or niche business.

How to get started: Mainvest allows you to invest in small businesses by providing loans. Minimums start at just $100.

#8. Private Credit

Private credit investing entails lending money to private companies or individuals in exchange for a fixed rate of return. These are considered high-risk loans, as you’re working with those unable to get a traditional bank loan.

The most common types of private credit investing include merchant cash advances, working capital loans and hard money loans. These loans are secured by collateral — such as real estate, inventory or equipment — and have relatively short durations of anywhere from three months to six years.

Best for: The private credit market is attractive for high-net-worth investors who are holding cash and looking to diversify into alternatives. Most investors who opt for private credit over real estate are drawn to the shorter duration loans, which provide better liquidity.

How to get started: For finding private credit opportunities, you can check out Percent. Similar to how sites like Cadre, Fundrise, and CrowdStreet allow people to easily invest in real estate, Percent allows accredited investors to invest in various private credit opportunities. Learn more in our Percent Investing review.

Types of Alternative Investments

The list above outlines some of my favorite alternative investments, but there are even more asset classes that can be used to diversify a portfolio. Here’s a quick, alphabetized list of some of the most popular ideas.

- Collectables

- Cryptocurrencies

- Debt (such as P2P lending)

- Farmland

- Equipment leasing

- Gold and other precious metals

- Hedge funds

- Intellectual property

- Natural resources (such as oil)

- NFTs

- Private equity

- Real Estate

- Structured products

- Timber

- Wine