Some investments offered only to accredited investors have the potential to both diversify your portfolio and provide growth. In this article, we’ll look at eight opportunities to consider in 2022, along with where they may fit into your overall financial plan.

But first, let’s take a look at the recently-updated accredited investor qualification guidelines.

Jump To

How to Become an Accredited Investor

An accredited investor has the right to trade securities that are not registered with the SEC. Investors can invest themselves, or go through an entity, like a hedge fund*.

To be classified as an accredited investor, you must meet one of the following qualifications:

- Possess certificates or some other form of proof that you have the needed expertise to trade in the unregistered investments. (This qualification requirement was only recently added by the SEC).

- Have a minimum net worth of $1 million, excluding the value of your house.

- Have earned an income of $200,000 ($300,000 for couples) for each of the last two years. You may also be requested to provide proof that you’ll meet the threshold in the next year.

There is no formal registration process to become an accredited investor. Instead, the seller of the unregistered security is required to verify its investors.

Companies offering different investment products have varying ways to determine whether someone is an accredited investor. Typically, you should expect to provide the following information for verification:

- Past financial information.

- Tax returns.

- W-2 forms and/or the equivalent, to determine earnings.

- Professional certifications or credentials from the Financial Industry Regulatory Authority.

For further details, refer to the SEC’s Accredited Investor Qualification Guide.

Accredited Investor Opportunities

As an accredited investor, you have access to certain investments that aren’t available to the general public. They’re usually higher risk, but when utilized properly, they can yield higher returns.

Here are eight potential accredited investor opportunities to consider for your portfolio.

#1. Real Estate

Accredited investors gain access to a number of real estate investment opportunities, which include:

- Crowdsourced real estate platforms.

- Real estate syndication companies.

- Private equity or hedge funds that specialize in real estate.

Dozens of real estate investing platforms have popped up in the last decade. Some are open to all investors, and some are just open to accredited investors. The platforms dedicated to accredited investors tend to have more focused strategies with very limited deal flow.

Cadre is one name to check out amongst the platforms open to accredited investors. They specialize in institutional-quality assets, including investments in opportunity zones. Since its launch in 2015, Cadre has acquired over 40 properties across 24 markets in the United States and returned more than $292 million dollars to its investors.

Learn more in our Cadre Review.

Similar to real estate crowdfunding, there is real estate syndication. The term “syndication” is typically used to describe smaller private real estate deals, where a group of investors share a personal connection.

Private equity and hedge funds that specialize in real estate tend to be larger than syndicates while specializing in a specific approach to real estate investing. Syndicates usually take investors’ feedback into consideration for each deal, while private equity and hedge funds are more of a hands-off way to invest.

#2. Farmland

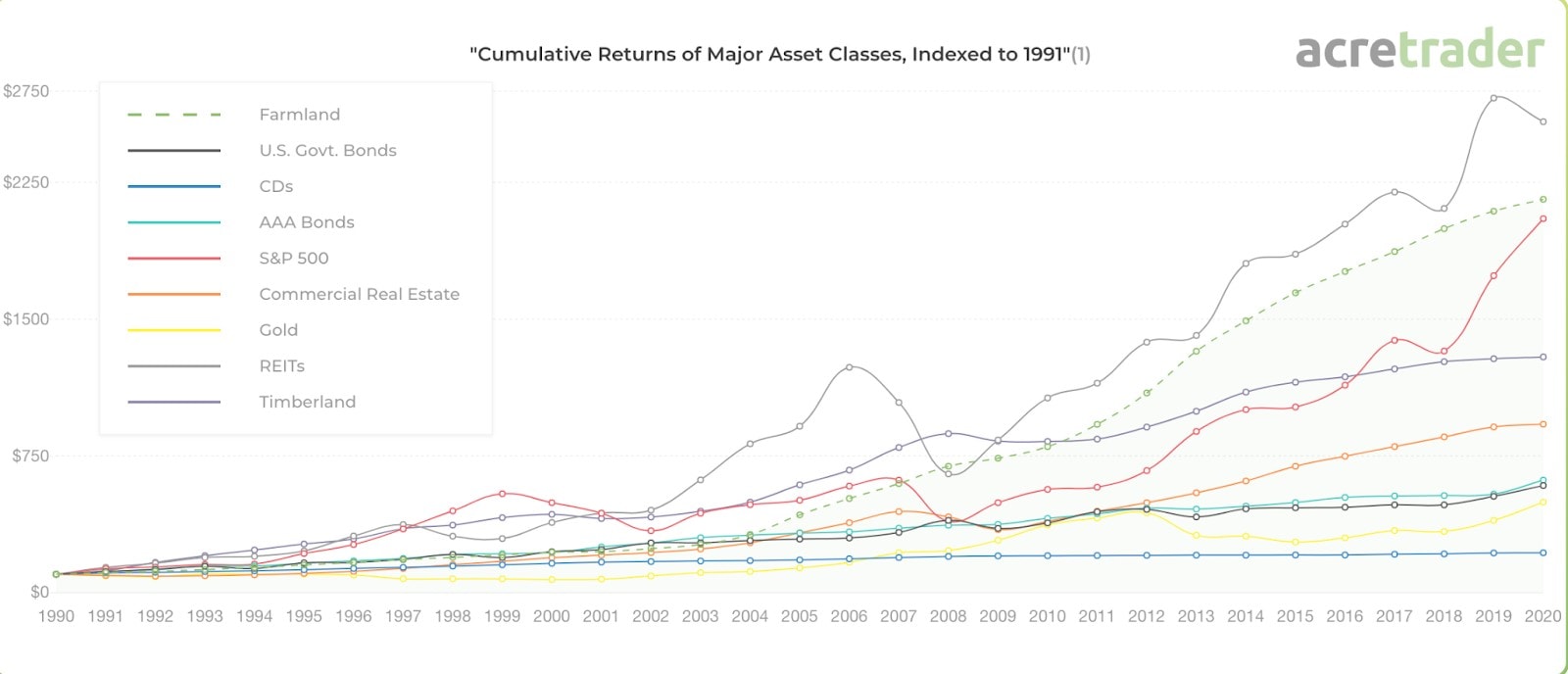

Investing in farmland has traditionally required substantial capital and labor, putting it out of reach for most investors. That’s unfortunate because, since 1990, farmland returns have outperformed the stock market. Moreover, Farmland only experienced a third of the volatility of the stock market.

Similar to real estate, a number of crowdsourced platforms have popped up for accredited investors to invest in farmland.

AcreTrader is a crowdfunding platform that focuses exclusively on farmland. With AcreTrader, each farm is listed as a private placement, in which members have the opportunity to invest. AcreTrader then charges a 0.75% management fee.

Investors receive an annual dividend payment — expected to be around 3% to 5% — of the initial investment. Plus, they earn appreciation when the property is sold. Properties are held from five to 10 years. In addition, a secondary marketplace is offered for investors who need liquidity before the sale.

Visit AcreTrader to learn more.

#3. Angel Investing

Angel investors provide seed money to early-stage companies — often as early as during the ideation phase, when no product or service is actually available.

While anyone can invest money in an early-stage startup and call themselves an angel investor, traditional angel investing describes a more formal process where companies are actively seeking capital from a diverse set of investors.

Currently, the SEC limits the number of non-accredited investors an entity can have, and those slots are typically taken by close friends and family of the founders.

If there is a successful exit from your investment — which may include a sale of the company or an IPO — the time frame is most often around five to 10 years.

Unless you have a large personal network of founders, many angel investors source their deals on sites like AngelList and Republic.

With these platforms, you can connect directly with companies or funds, which allows you to co-invest alongside others.

For a good primer on angel investing, check out Meb Faber’s in-depth post “Journey to 100X.”

For later-stage investing, consider the platform Linqto, which allows you to invest in established and fast-growing tech companies. On Linqto, you’re often buying shares from founders and early-stage employees who are looking for a partial exit from companies with existing valuations of $100 million or more.

#4. Hedge Funds

Hedge funds allow investors to invest in different (and often more complex) asset classes managed by an experienced professional or team.

There are dozens of types of hedge funds, from real estate to crypto.

Data from Axios on hedge funds that specialize in equities shows that most hedge funds lag the S&P 500 after fees.

This is in line with the research from KKR, which has shown that the performance of hedge funds in publicly available investments rarely outperforms the median. It’s instead in alternative asset classes where there is a larger difference between average and the top managers.

In other words, a more passive investment approach would be more favorable in stocks, but some hedge funds in the alternative asset space are able to provide above-average risk-adjusted returns.

The goal then becomes to pick the right managers within the highly specialized asset classes that outperform.

#5. Private Equity Funds

A private equity fund works similarly to a hedge fund, where the investor’s money is managed by a group of experts at the PE firm.

The difference with private equity is that it’s most often correlated with longer-term investments.

For example, a private equity fund may buy a stake in a company, and by doing so control the management and dictate the direction of the company with the aim of making it profitable.

Compare this to a hedge fund, which may make short-term trades; private equity deals are for longer-term focused investors.

Many of the U.S.’s largest pension funds are investing more in private equity funds, with the average holding reaching an all-time high of 8.9%.

Minimums for some of the top private performing private equity firms tend to run high — often in the millions. Smaller PE firms’ minimums get as low as six figures.

#6. Asset-Backed Securities

Asset-backed securities are a type of security that’s created by pooling different securities together. This is often achieved by combining multiple loans into a single offering, which is then offered to investors.

Most often linked to mortgage debt, there are asset-backed securities that include aircraft leases, credit card receivables, business loans and more.

One of the distinguishing characteristics of asset-backed securities is that they’re high risk because the securities contain only a fraction of the pooled underlying assets. However, asset-backed securities have the potential of earning high returns with this leverage.

Some of the advantages of investing in asset-backed securities include:

- Protects you from risky loans.

- Opens up an alternative investment classes.

It’s also important to understand some of the risks, which include:

- Lack of due diligence to understand the individual offerings.

- Low repayment in case of a crisis.

- Typically have lower yields from prepayments.

One company helping people invest in a variety of asset-backed securities is Percent. With Percent, you can invest in different private credit investments, similarly to how most crowdfunded real estate platforms work. Types of investments include short-term financing for businesses, crypto asset-collateralized loans, and merchant cash advances. You can learn more in our review of Percent review.

#7. Private Placements

A private placement is an offering to limited investors that’s aimed at raising capital for startups. The company needing the capital sells its shares or other interests in the company and in return receives the cash.

This is different from angel investing in that the company is looking specifically for investments from a pre-qualified and very limited group of investors.

Private placements are highly regulated and, based on who they are selling to, there is a limit to how much equity they can offer the investor.

One of the primary reasons to use private placements as an accredited investor is that it allows you to purchase shares that aren’t publicly traded or registered with the SEC, which allows for more flexibility in the asset classes.

Moreover, it’s possible for investors to gather more information beyond what is provided in the offering documents, which helps them identify whether the investment is worth the risk or not.

#8. Venture Capital Funds

Venture capital funds provide capital for startups and small businesses in exchange for a stake in the company. This money is then used for expanding new lines of business or for funding day-to-day activities.

Technically, it’s a form of private equity investing, with a very specific focus on early-stage startups. The fund as a whole is managed like a mutual fund, pooling investors’ money together. Profits are then split between the VC fund and its group of investors.

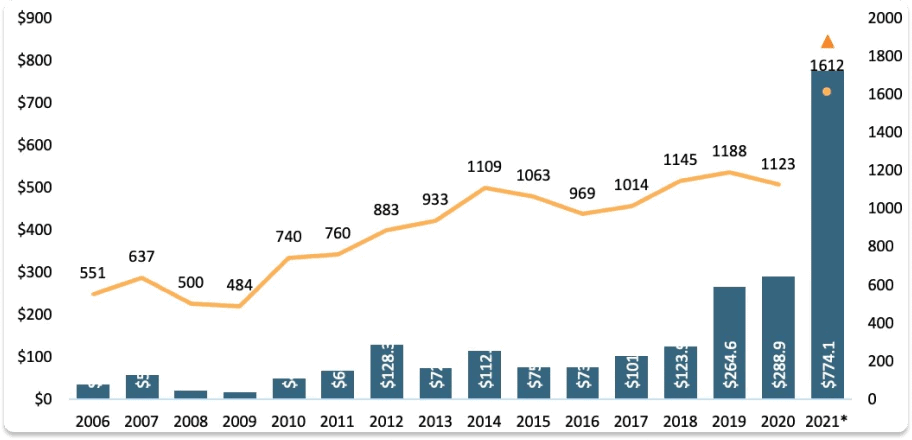

In 2021, inflows in venture capital were greater than $300 billion for the first time.

Similar to a hedge fund, the key to successful venture capital investing is manager selection.

Venture capital funds have among the widest performance spreads of any alternative asset class, with some managers returning below 0%.

Do Accredited Investors Get Higher Returns?

Not always. While accredited investors do get access to a wider array of investments, there’s no guarantee that they’ll outperform an index-based approach.

The now-classic Wall Street Journal article titled “Hanging With the Hedge-Fund Bros to Get the Story” interviews Gary Shteyngart, who spent four years hanging out with the world’s elite hedge fund managers.

One of the quotes from the story says a lot:

“Some of the coolest guys I’ve ever met in this industry say, ‘Let me tell you a secret, Gary: low-cost index funds,’ ” he said. “They’re like, ‘Don’t invest in our stuff. Just low-cost index funds’.”

What does the data say?

The ultra-high-net-worth investor — someone with $30 million or more in assets — is able to significantly outperform the high-net-worth investor. Data from KKR shows that ultra-high-net-worth investors were able to generate average returns of between 8.8% and 12.4%, while high-net-worth investors generated returns between 2.5% and 5.4%.

Much of the disparity comes down to manager selection. UHNW investors have the network to access the best managers, while access to the best managers is limited for HNW investors.